|

|

Monday, sep 04, 2017 Share this Article |

|

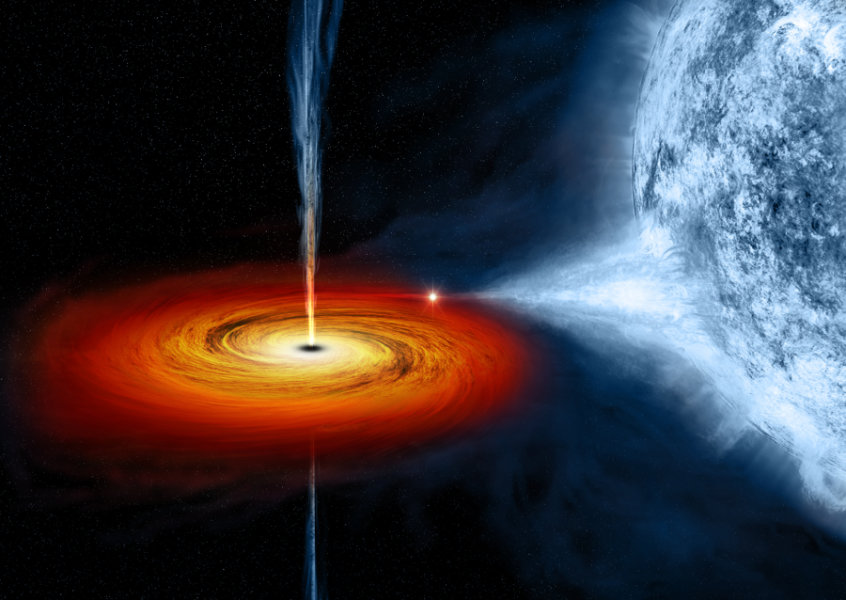

Astronomers detect orbital motion in pair of supermassive black holes

Using the supersharp radio "vision" of the National Science Foundation's Very Long Baseline Array (VLBA), astronomers have made the first detection of orbital motion in a pair of supermassive black holes in a galaxy some 750 million light-years from Earth. |

10 Golden Rules To Professional Ethics In The Workplace

Professionalism is the conduct, aims or qualities that characterize or mark a profession or professional person; it implies quality of workmanship or service. Every organization knows that a professional reputation is the difference. |

|||

|

||||

|

How GST impacts you in your day-to-day life

As most of our readers are already aware, the GST council has finalised the GST rates across different goods & service categories. The tax range is divided into the different slabs i.e. 0%, 5%, 12%, 18% & 28%. Let's see how your life changes with the introduction of GST and how much more or less you need to shell out from your pocket. |

India, say hello to GST! Biggest-ever tax reform comes into effect

With the press of a button at midnight in Parliament’s Central Hall, India switched to GST, the single biggest tax reform undertaken by the country in 70 years of independence. Launching GST, President Pranab Mukherjee said it is a momentous event for the nation. |

|||

|

Detailed Articles |

||||

|

Astronomers detect orbital motion in pair of supermassive black holes

Using the supersharp radio "vision" of the National Science Foundation's Very Long Baseline Array (VLBA), astronomers have made the first detection of orbital motion in a pair of supermassive black holes in a galaxy some 750 million light-years from Earth. The two black holes, with a combined mass 15 billion times that of the Sun, are likely separated by only about 24 light-years, extremely close for such a system. "This is the first pair of black holes to be seen as separate objects that are moving with respect to each other, and thus makes this the first black-hole 'visual binary,'" said Greg Taylor, of the University of New Mexico (UNM). Supermassive black holes, with millions or billions of times the mass of the Sun, reside at the cores of most galaxies. The presence of two such monsters at the center of a single galaxy means that the galaxy merged with another some time in the past. In such cases, the two black holes themselves may eventually merge in an event that would produce gravitational waves that ripple across the universe. "We believe that the two supermassive black holes in this galaxy will merge," said Karishma Bansal, a graduate student at UNM, adding that the merger will come at least millions of years in the future. The galaxy, an elliptical galaxy called 0402+379, after its location in the sky, was first observed in 1995. It was studied in 2003 and 2005 with the VLBA. Based on finding two cores in the galaxy, instead of one, Taylor and his collaborators concluded in 2006 that it contained a pair of supermassive black holes. The latest research, which Taylor and his colleagues are reporting in the Astrophysical Journal, incorporates new VLBA observations from 2009 and 2015, along with re-analysis of the earlier VLBA data. This work revealed motion of the two cores, confirming that the two black holes are orbiting each other. The scientists' initial calculations indicate that they complete a single orbit in about 30,000 years. "We need to continue observing this galaxy to improve our understanding of the orbit, and of the masses of the black holes," Taylor said. "This pair of black holes offers us our first chance to study how such systems interact," he added. The astronomers also hope to discover other such systems. The galaxy mergers that bring two supermassive black holes close together are considered to be a common process in the universe, so astronomers expect that such binary pairs should be common. "Now that we've been able to measure orbital motion in one such pair, we're encouraged to seek other, similar pairs. We may find others that are easier to study," Bansal said. The VLBA, part of the Long Baseline Observatory, is a continent-wide radio telescope system using ten, 240-ton dish antennas distributed from Hawaii to St. Croix in the Caribbean. All ten antennas work together as a single telescope with the greatest resolving power available to astronomy. That extraordinary resolving power allows scientists to make extremely fine measurements of objects and motions in the sky, such as those done for the research on 0402+379. The Long Baseline Observatory is a facility of the National Science Foundation, operated under cooperative agreement by Associated Universities, Inc. Article Source |

||||

|

10 Golden Rules To Professional Ethics In The Workplace

Professionalism is the conduct, aims or qualities that characterize or mark a profession or professional person; it implies quality of workmanship or service. Every organization knows that a professional reputation is the difference between success and failure and they seek to keep their most professional staff. Professionalism is all about success and influence; having a reputation for excellence and being thought of as someone who exhibits professionalism under any circumstances can open doors for you either in the workplace or in your personal ambition. Following are ten golden rules to being professional in service to your organization:

Article Source |

||||

|

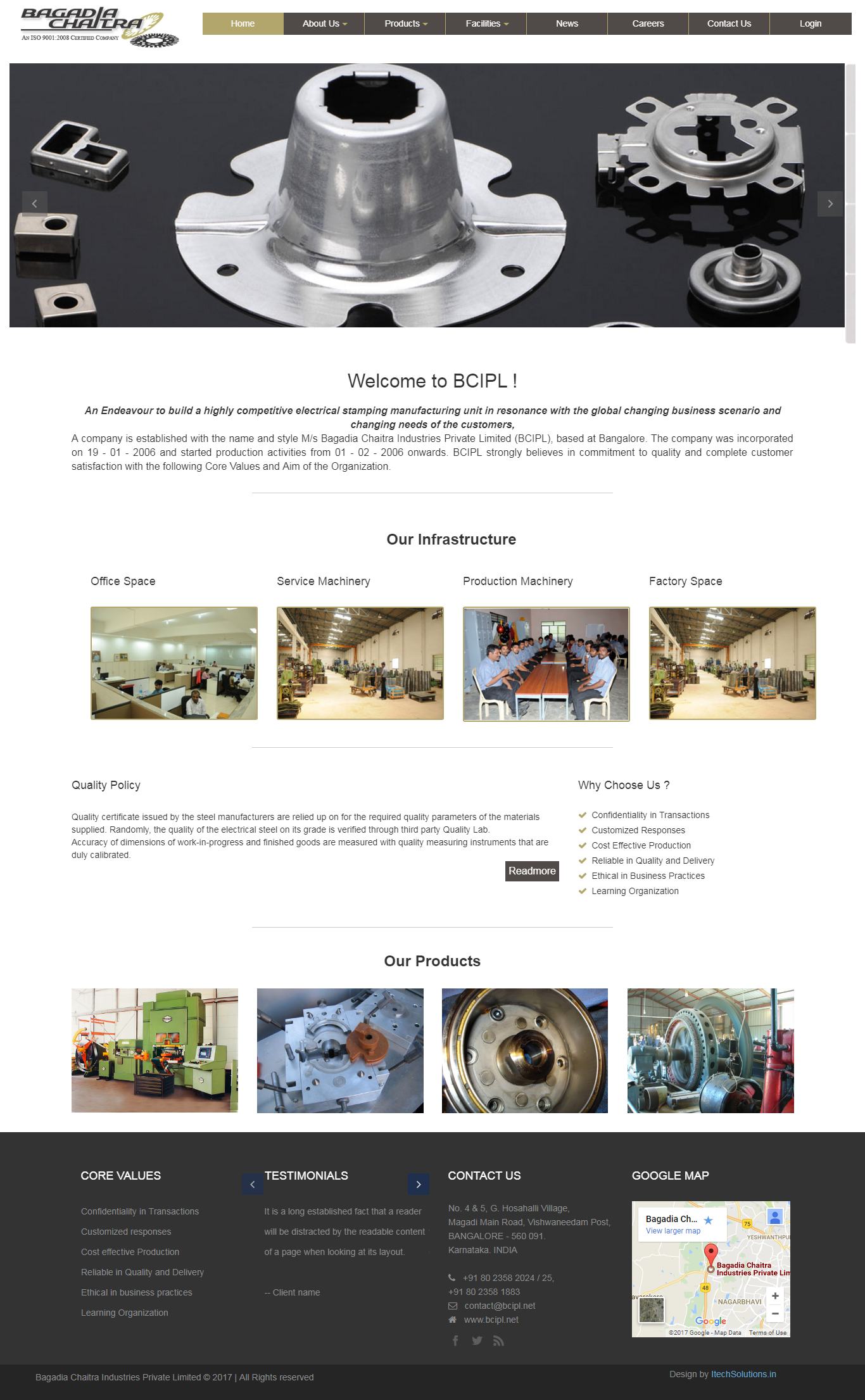

BCIPL

Itech Solutions has bagged an opportunity to develop a Real Time ERP (Enterprise Resource Planning) project with Producion, Inventory, Purchases, sales, Accounts and HR etc. modules. The Company will produce Stampings, Sub-assemblies and Die-Cast Rotors to the required quality parameters as specified by the customers, by strictly adopting the due process of manufacture and ensuring quality during each production process. The purpose is to reduce the manual work, because they are maintaining excel sheet. In this project Inventory and HR module calculations will happn through software, in HR module employee can apply for leave and he can see status of the leave. We given ERP software to maintain their business, in that recently we developed a new concept called Purchase Order calculation with “N” number items. Previously everything was being done manually by using Excel sheet which was confusing & time consuming. Using Excel sheet had its own drawbacks which included system crash, file lost and mistake in calculations etc. To solve this problem we did each and every item will come up with different id’s and there is no problem for calculation of the price, giving discount, freight charges and tax etc.. and Grand total will come in fingertips. They can easily generate PO within seconds without any difficulties. This Project Developed as a web application on J2EE technologies, which is a time based and reliable option for ERP project. It provides admin to keep track the details of Inventory, HR, Production module. Admin can easily generate the excel reports. Reports save huge amount of time and enable the department faculty to take effective and quick decisions about purchase and leave status. The major module includes: Register, Login, Various Reports, Inventory module,Hr module,Production module, end to end data handling for various reports. The Real Time Inventory application will help the vendor to better manage the purchase request, purchase order, goods receive note and production, closely monitor their progress and Real time with calculation and reports. |

||||

How GST impacts you in your day-to-day life

As most of our readers are already aware, the GST council has finalised the GST rates across different goods & service categories. The tax range is divided into the different slabs i.e. 0%, 5%, 12%, 18% & 28%. Let's see how your life changes with the introduction of GST and how much more or less you need to shell out from your pocket. Footwear:Be ready to shell out more for footwear which costs more than Rs 500 as the GST rate is kept at 18% as compared to the earlier 14.41%. However, the rate for footwear costing below Rs 500 is reduced to 5%. Garments:Buying your next shirt or trouser will cost you a little less as the GST rate for ready-made garments is reduced to 12% from the existing 18.16%. Cab & taxi rides:Even booking your cab is slightly cheaper now as the tax rate is reduced to 5% from 6% for any taxi booked online like on Ola, Uber or Meru. Airline ticket:There is no change for an economy flight ticket price but GST for a business class ticket will attract 12% rate. Train tickets:There is hardly any change as far as your railway ticket price is concerned because the rate has increased to 5% from the existing 4.5%. There is a benefit given to the passengers traveling for business as now they would be able to claim the Input Tax Credit for their rail ticket expenses. Your local or sleeper class ticket will remain the same, but the first class/AC ticket price has risen. Movie tickets:Watching a movie with a ticket price of less than Rs 100 will attract 18% GST but the higher ticket i.e. more than Rs 100 will attract 28% GST. In fact your ticket price will also depend on the state where you are watching a movie. Premium on your Life Insurance policy: Due to the rise of 3% rate i.e. GST rate of 18% from an existing service tax rate of 15%, you will end up paying more premium for your insurance policies. The same has been kept for all the insurance categories i.e. life, health and general insurance. Jewellery:Gold investment will be slightly more expensive due to a higher GST rate. Buying real estate:If you are planning to buy an under construction real estate property, then you will stand to get more benefit than a ready to move in property. Your builder will get input tax credit and can pass on the same to you in terms or reduced prices. Hotel stay:For a room rent of less than Rs 1,000, there wont be any GST, but in case it is more than Rs 5,000 then it will have a GST rate of 28%. Buying a car:Most of the cars across different segments will become cheaper but the same will not be applicable for hybrid cars as the GST rate is 28% on all the vehicles irrespective of its make, model or engine capacity and also depends on a particular car segment. Mobile bills:Your phone bill is set to rise by 3% because GST on telecom services is 18% than an earlier 15%. Restaurant bills/ Eating out:It depends on the type of restaurant you are dining in, i.e. whether it is an AC or Non-AC restaurant and whether it serves alcohol or not. Dining at a five-star hotel is kept at 18% GST rate. The Non-AC restaurant is kept at 12% rate & a 5% GST for a small hotel, dhaaba and restaurant whose yearly turnover is less than Rs 50 lakh. IPL ticket price & other events:Your IPL ticket or ticket for any other sports event will be charged 28% GST from an existing 20%. rate. But for theatre, circus, classical music program or even a folk dance function is kept at 18% GST which is lesser than the earlier rate. DTH/cable services:The charges for your Tata Sky/ Dish TV or your cable operator will reduce slightly as the entertainment tax is also done away with. Amusement park:The price for your amusement park ticket say Imagica or any theme park similar to that is set to rise due to 28% GST rate. Article Source |

||||

|

India, say hello to GST! Biggest-ever tax reform comes into effect

Launching GST, President Pranab Mukherjee said it is a momentous event for the nation. "This historic moment is the culmination of 14-year-long journey that began in December, 2002," he said. Touting it as a gamechanger, PM Modi said GST will put India on path of a system that will be transparent, simple and keeps tabs on corruption. GST is the outcome of a thought process over several years," Modi said, thanking the GST council behind this landmark tax reform. "GST does not belong to one government, it is a collective effort." The one national GST unifies the country's USD 2 trillion economy and 1.3 billion people into a common market, an exercise that took 17 tumultuous years. "GST will end tax terrorism and inspector raj, two big hurdles to the country's growth," Modi said. Recalling Pandit Jawaharlal Nehru's tryst with destiny speech at Parliament's Central Hall, the PM said there could not be a better launchpad for GST to chart a new course for the country. "GST rollout is mark of cooperative federalism. This reform will show a new direction to nation building. This is a mark of Team India." Modi said the GST will end India's multiplicity of taxes and the confusion, making India independent of the effect of cascading taxes. "It is Good and Simple tax." GST replaces more than a dozen levies with a new goods and services tax. That should help reduce the immense power India’s myriad middlemen wield at state borders, free up internal trade, make it easier to do business and widen the country’s tiny tax base. What it means for India:1) It gives the country one uniform tax, and no frequent rate changes 2) A lower tax burden. One market to help businesses. No truck queues at state borders 3) GDP could rise by 2% 4) Less scope for evasion, which means higher revenues 5) Lower taxes to boost exports 6) Inspector raj will ease its grip What it means for businesses:1) No fear that a state will randomly raise taxes 2) Transparency in taxes 3) Easy because only one tax to account for 4) Automated process means less babudom 5) Goods and services providers will get the benefit of input tax credit for the goods used, effectively making the real incidence of taxation lower than the headline taxation rate. Rate classification for services:Only rates of select goods and services have been mentioned here

GST rate on pearls, precious or semi-precious stones, diamonds (other than rough diamonds), precious metals (like gold and silver), imitation jewellery, coins – 3% GST rate on rough diamonds – 0.25% Article Source |

||||